Beyond these requirements, getting started in freelance accounting calls for little more than a laptop and typically, business insurance—plus a solid dose of personal ambition. For a smarter solution to these problems, you can use expense tracking software. Our guide, Expense Tracking for Freelancers, will provide you with more insight into this. Keeping track of all income for small businesses can be difficult, so utilizing freelance accounting software to record income and tax dollar amounts may be the best accounting solution around. The best accounting software for you is the one that’s the simplest to use, reducing your stress level as you track your finances.

New tax year: what’s on the horizon for accountants and bookkeepers?

To protect your cash flow and achieve your projected income, it is important to ensure you are getting paid accountant for freelancers on time by clients. It can be hard to keep track of your clients and when and how much they should pay you. Understanding how to manage your accounting and the tools you can use will help you stay on top of outstanding invoices and collect payments from clients who owe you money. Keeping track of your clients’ payments—when and how much they owe you—can be challenging.

Best Websites for Hiring Freelance Accountants in 2025

- In 2020, freelancing (working for clients independently on a per-job basis) was already increasing at a steady rate in the United States.

- Invoicing late or not getting paid on time can seriously hurt your business and lead to both short-term and long-term financial difficulties.

- The CPA certification is primarily a US designation, although some countries have mutual recognition agreements that allow CPAs to practice outside the US and accountants with similar qualifications to practice in the US.

- Reconciling your bank account can make the day-to-day business of freelancing easier and prepare you for tax season.

- The company boasts a hassle-free process for helping clients find and hire CPAs and other freelancers around the world.

The company promises to deliver a personalized, unmatched experience to all clients. Accountingfly offers US-based accounting talent with an average placement time of four weeks. You should open a separate bank account for business transactions to ensure everything is clear. Bookkeeping Insurance Accounting services are another great way to help manage your business finances. They provide efficient support bookkeeping, tracking expenses, and making the most of your tax deductions, helping you save money and reduce the likelihood of a tax audit.

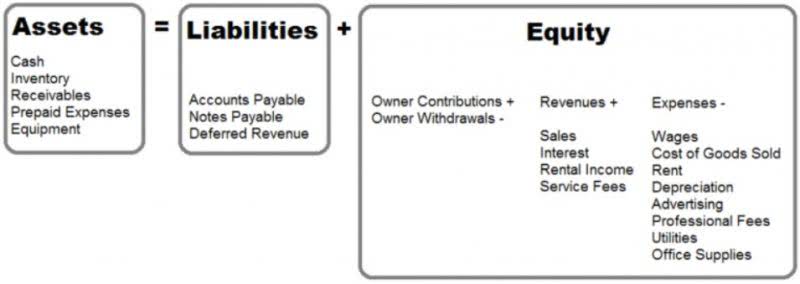

Fiverr: Best Prices for Skilled Accountants

Freelancers should do bookkeeping at least once a month but you can go over accounts more frequently if you wish. Some will do it at the end of every week, while others go over their bookkeeping daily, depending on your transaction volume. It’s not fun to think about things that unexpectedly go wrong in your life that could impact your business. Good bookkeeping can prepare you for anything from a legal proceeding with an angry client to a difficult divorce. You can reconcile all your transactions within minutes when you get a live bank feed. Comparing different periods can give you a true picture of your business cycle and assist with budgeting through ebbs and flows during the year.

Most accountants specializing in taxation are called tax accountants and are generally paid higher than those without specialization. For example, year-end tax or quarterly tax dues are highly complicated to navigate, especially for people who are not well-versed with intensive tax regulations. Having an accountant around can help you comply with your tax dues to avoid penalties and surcharges. Small businesses can expect to pay a freelance bookkeeper around $50 to $100 USD an hour. The price depends on the complexity of your needs and the bookkeeper’s experience and qualifications.

- Comparing different periods can give you a true picture of your business cycle and assist with budgeting through ebbs and flows during the year.

- In that case, be sure to confirm the person you intend to hire is qualified and permitted to do the work you need them to do.

- If you don’t separate your business account and personal accounts, you can get paid straight to your personal bank account, which can make it tempting to brush things under the rug.

- The price depends on the complexity of your needs and the bookkeeper’s experience and qualifications.

- One of the main benefits of being a freelance accountant is that you get to set your own agenda.

Reconciling your bank account can make the day-to-day business of freelancing easier and prepare bookkeeping you for tax season. Having separate accounts gives a more straightforward visual of how much money you have linked to your business at any time. This will help with bank reconciliation, make it easier to budget, and provide costs for your services. Newer freelancers might be used to having an employer automatically deduct a portion of their earnings from each paycheck to cover their income taxes.

Business Plan Consultants

Whether you use an accountant for tax season or not, it is important to have a handle on your finances all year long. Set your freelance career up for success by allocating time daily or weekly, depending on transaction volume, to organize your bookkeeping and ensure you enter in every invoice or expense receipt. When you’re keeping a consistent and accurate log of your business activities you can understand your business better and have an accessible view of your cash flow. FreeAgent’s award-winning accounting software is friendly, easy to use and doesn’t require any add-ons. One of the main benefits of being a freelance accountant is that you get to set your own agenda.